49+ can you write off interest paid on your mortgage

Downgrading a credit card is when you change it out for a card in the same family that has a lower annual fee. LawDepot Has You Covered with a Wide Variety of Legal Documents.

The Trucker Clogs In A Bad Way Direct From Denmark

Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million.

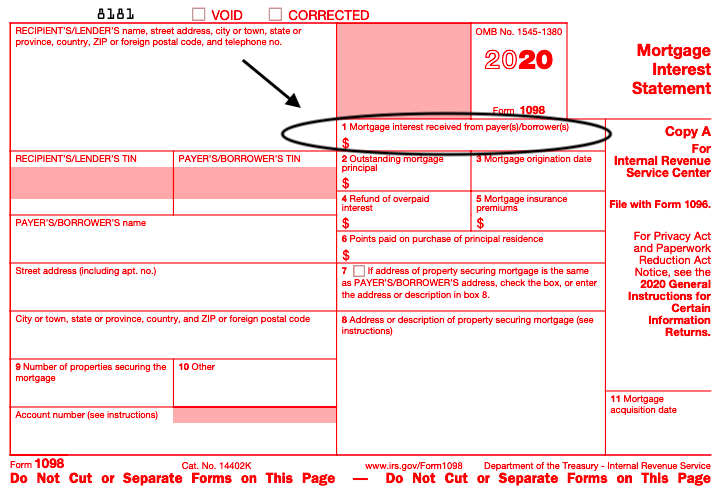

. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

If you took out. Single or married filing separately 12550. Web Important rules and exceptions.

One of the main reasons to downgrade a. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Web 4 hours agoSay for example that you have a mortgage loan of 240000 over 360 months at an interest rate of 4.

Create Your Satisfaction of Mortgage. Web For 2021 tax returns the government has raised the standard deduction to. However higher limitations 1 million 500000 if married.

Web You can only deduct a total of 10000 5000 for those married filing separately for property taxes plus state and local income taxes or sales tax instead of. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Now the loan limit is 750000.

Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up. Your initial monthly mortgage payment is 1146. Married filing jointly or qualifying widow.

Web Most homeowners can deduct all of their mortgage interest. Web This can save you a lot of money on your tax bill. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web If your home was purchased before Dec. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. Ad Developed by Lawyers. Web 2 hours agoKey points.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. At least in most circumstances you can. Web Keep in mind that mortgage points arent the only deduction you can claim as a homeowner.

You must also have a. Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender.

You may still be able to. You see in the US mortgage interest is considered tax-deductible. Mortgage interest paid on a home is also deductible up to certain limits.

You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took. Web You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to buy the property or to. This means when you file your taxes and have to pay a.

That means for the 2022 tax year married.

49 Mobile App Ideas That Haven T Been Made 2023 Update

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc

Stab Des Aufsehers Gegenstand World Of Warcraft Classic

Kaiserslautern American May 29 2020 By Advantipro Gmbh Issuu

50th Birthday Card Funny Women Novelty Old Middle Finger Rude Birthday Cards Men 145mm X 145mm Birthday Cards Mum Step Dad Sister Brother Aunt Uncle Amazon De Stationery Office Supplies

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction A 2022 Guide Credible

Nord Lb Group Annual Report 2007 Pdf 1 8

Mortgage Interest Deduction Bankrate

Mortgage Interest Tax Deduction What You Need To Know

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

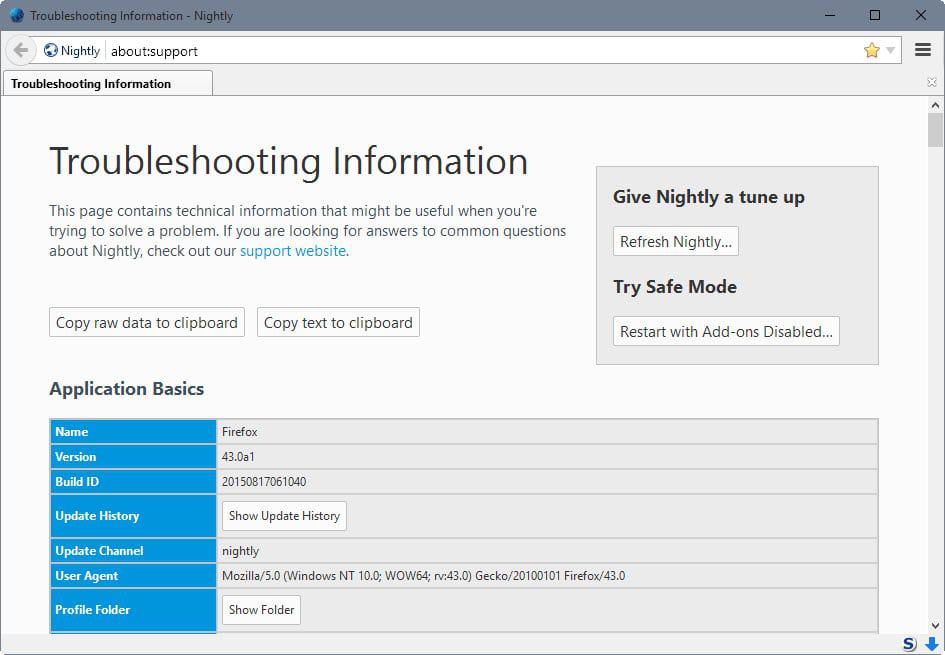

A Comprehensive List Of Firefox Privacy And Security Settings Ghacks Tech News

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Sgd Inr Crosses 50 Aditya Ladia

The Trucker Clogs In A Bad Way Direct From Denmark